7月17日,英国金融市场行为监管局(FCA)发布了一份 consultation paper 全球最大的博彩平台企业推广金融服务和产品的社交媒体指导.

到目前为止,该指南草案并没有包含任何新的内容,包括宣传材料的“注意事项” new rules 将于今年10月8日生效,旨在促进与加密相关的投资(见相关文章) here).

However, 它要解决的问题是“有影响力的人”在社交媒体上发帖占主导地位,以及一些惊人的统计数据, 例如,58%的40岁以下“投资高风险投资产品”的人告诉FCA,“社交媒体影响了他们的投资决策”,74%的关注“网红”的人表示,他们相信自己收到的建议.

美国证券交易委员会(SEC)对一些媒体人士采取了严厉措施, including Kim Kardashian and basketball player Paul Pierce,在不披露其货币利益的情况下推广代币. Other celebrities, 马特·达蒙和拉里·大卫等人也因参与加密相关业务的广告而受到抨击.

It appears that the FCA is following the SEC’s path. Social media posts will be treated as any formal promotion or inducement to make trading or investment decisions: risk warnings will need to be included; and there will be mandatory cooling-off periods for decisions.

This should come as no surprise, given that back in 2013, FCA的马丁·韦奕礼(Martin Wheatley)(时任首席执行官)表示,买者自负原则“难以捍卫”,而新的消费者责任即将出台.

然而,FCA和行业必须解决一些复杂的问题:

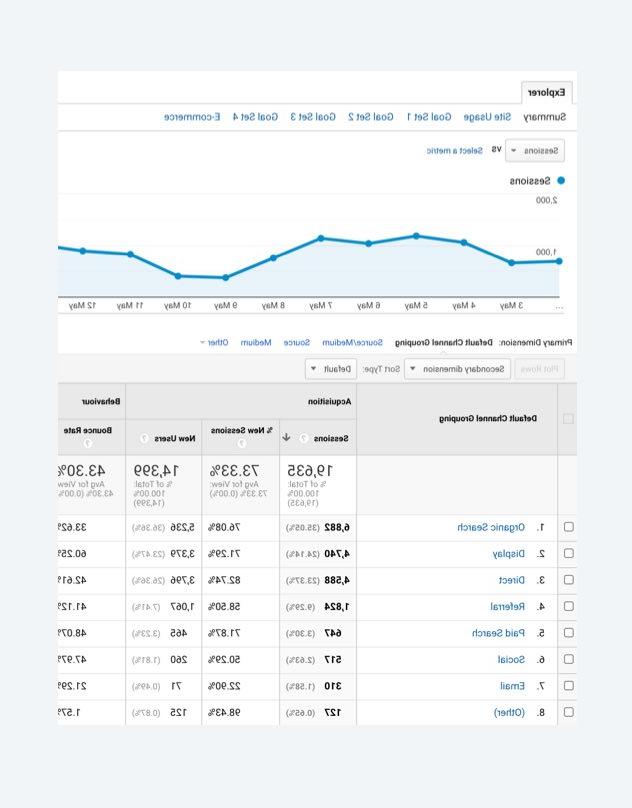

- how to monitor “finfluencers” and their posts, and what to do once a post is identified: on 8 July, the Financial Times published an article 全球最大的博彩平台英国金融向英国政府提出的请求——他们收集的数据表明,61%的“已报告的授权推送支付欺诈行为与Meta (Facebook的母公司)有关”, Facebook Marketplace, Instagram和WhatsApp)——迫使科技公司对其网站上的内容负责, something which has proved very difficult to do;

- to determine what is (or is not) an “adequate risk warning”: the FCA provides (on page 16 of the Consultation) a side-by-side example of a “non-compliant” and a “compliant” promotion; it is the author’s humble opinion that if one was scrolling through social media in the ordinary way, the differences between the two do not leap-out; in any case, the FCA states that the ‘take 2 mins to learn more’ statement is not required “if its inclusion is not possible”; so confusion might well reign for some time (although to give the FCA credit, 它提供了多个风险警告及其预期的例子);

- who has jurisdiction: the FCA provides an infographic from the UK Advertising Standards Agency (see page 24) and what happens where the “finfluencer” is overseas; and

- 如何识别“finfluencer”并使“finfluencer”意识到他们的责任:FCA(正确地)转向了“在业务过程中行事”的个人定义(并给出了示例, starting on page 26), however, 例如,社交媒体帖子也有可能仅仅因为个人对金融产品或服务感兴趣而推广(或相反)某种金融产品或服务, 那些从事倾倒或垃圾和现金计划的人不需要与产品/服务提供商(和)有任何关系, of course, 许多代币在任何情况下都不会受到传统的市场滥用规则的约束)。.

We encourage all firms, 即使是那些涉及创造性代币应用(如促销NFT问题)的人也要仔细考虑本咨询意见及其相关问题.

If you have any questions, please do contact us.