The rise of Buy Now, “晚点付款”(BNPL)服务颠覆了传统的贷款格局, offering consumers a new way to finance their purchases. And as it continues to gain traction, 对于消费者和企业来说,理解这种另类融资模式的复杂性至关重要.

We`ll delve into the pros and cons of BNPL, 揭示其好处和潜在的缺陷,并为您选择适合您需求的BNPL提供商提供一些建议.

This article was composed in collaboration with our partner, Sileon. 我们的合作伙伴关系始于2023年5月,并成为一个令人兴奋的发展,推动创新,并以更多尖端的解决方案塑造金融科技格局.

This partnership combines Kindgeek’s deep fintech software development expertise Sileon可扩展的BNPL软件产品,包括平台和解决方案模块. While Sileon’s Platform acts as a core banking system for BNPL, 解决方案模块是可选组件,可以放置在平台的顶部,以提供额外的定制BNPL产品.

金迪克的核心经营理念是以客户为中心. 与Sileon的合作进一步加强了Kindgeek为金融机构及其客户的独特需求提供量身定制解决方案的承诺. Our combined expertise enables a shorter time to market.

它还允许我们为本文提供更深入、更复杂的见解. 继续往下读.

What is BNPL, and how does it work?

BNPL代表现在购买,以后支付,是一种短期融资,允许消费者购买并在一段时间内分期付款, typically a few weeks or months, instead of paying the total amount upfront. 它变得越来越受欢迎,一些最大的零售商和应用程序,如 贝宝, offer this service.

当你在网上结账时,你会经常看到BNPL付款计划. For in-store shopping, 供应商通常提供虚拟卡,可以从供应商的移动应用程序下载, saved to a mobile wallet and used at the register.

So how does it work? 让我们从客户的角度来看典型的流程:

- 在结账时,无论是在网上还是在店内,消费者都可以选择使用BNPL付款.

- 然后, they`ll typically have to fill out a short application, providing information like name, address, 电子邮件地址, 出生日期, 电话号码, and Social Security number.

- The purchase amount is divided into equal instalments, usually four or fewer, with the first instalment paid at the time of purchase.

- 剩余的分期付款将按时间表自动从消费者的借记卡或信用卡中扣除, typically every two weeks or monthly.

- 许多BNPL供应商不收取利息或按时付款的费用. 但是,如果错过或延迟付款,可能会产生滞纳金或延期利息.

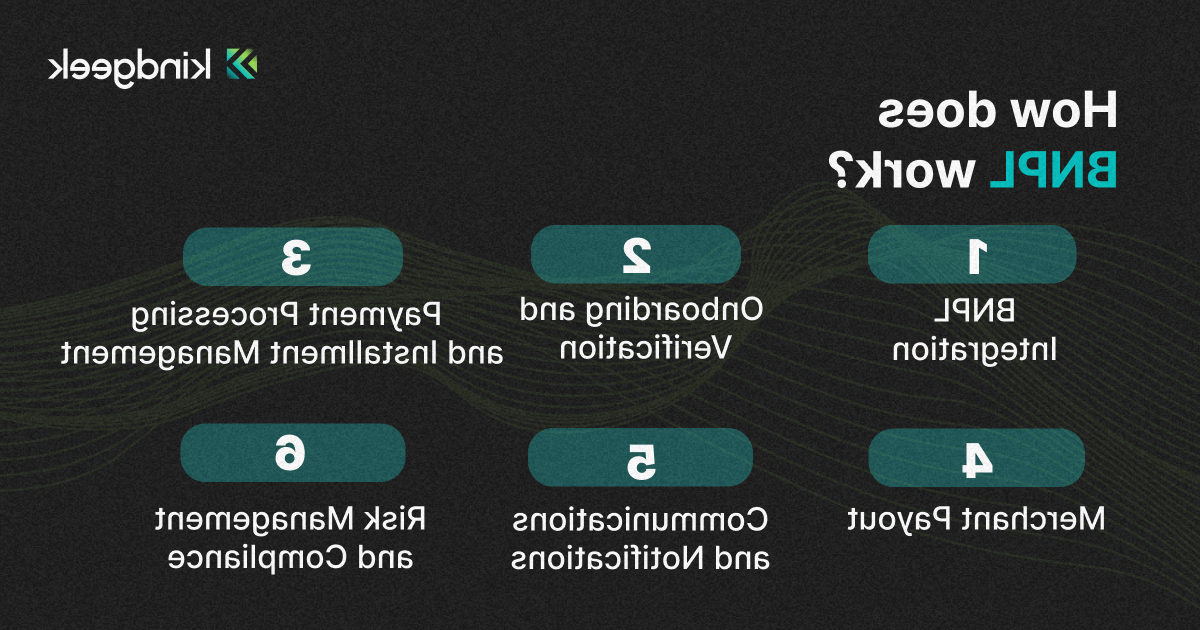

为了让这个过程对客户来说简单易行, bank card providers, 商人, and BNPL providers ensure some additional and essential steps:

BNPL集成

BNPL提供商提供api(应用程序编程接口)或软件开发工具包(sdk),允许银行卡提供商和商家集成BNPL支付选项. 这些集成使客户能够在结帐过程中选择BNPL选项并提供必要的信息.

Customer Onboarding and Verification

When customers choose the Buy Now Pay Later option, 提供商的平台收集并验证其个人和财务信息, 比如名字, 电子邮件, 电话号码, and debit or credit card details. 软信用检查或替代数据源可用于评估信誉度和欺诈风险.

Payment Processing and Installment Management

BNPL提供者处理初始首付款,并捕获客户未来分期付款的付款方式. The platform manages the instalment schedule, 自动收取客户的付款方式在预定日期的剩余分期付款.

商人支付

BNPL供应商通常会提前向商家支付总购买金额, minus any fees or commissions. This ensures that 商人 receive payment immediately, 而BNPL供应商则负责向客户收取分期付款.

Customer Communications and Notifications

BNPL平台通常有强大的通信系统来发送付款提醒, instalment due date notifications, and other customer updates via 电子邮件, 短信, or in-app notifications. 一些供应商提供客户门户或移动应用程序,客户可以在其中管理他们的BNPL订单, view payment schedules, and update payment methods.

Risk Management and Regulatory Compliance

BNPL供应商利用数据分析和机器学习算法来评估风险, 检测欺诈行为, and make informed decisions about extending credit to customers. They may use customer data, 购买历史, 以及外部资源来完善他们的风险模型并改善整体客户体验.

他们还必须遵守与消费贷款有关的各种规定, 数据隐私, and financial services, which may differ across jurisdictions. 他们的平台设计符合相关法律和行业标准.

5 reasons to add BNPL to your card (provided by Sileon)

As a bank card provider, integrating Buy Now, 在您的信用卡和借记卡产品中十大正规博彩网站评级延迟付款(BNPL)解决方案对您和最终用户都非常有益. 以下是为什么选择BNPL可以增强整体体验的几个令人信服的原因:

Increased Revenue and Profitability

整合BNPL选项可以显着增加您的借记卡和信用卡的盈利能力. 它开辟了新的收入来源,提高了持卡人的整体价值主张.

Modernise Your Cards and Attract New Customers

BNPL集成有助于超越现有持卡人的数字期望,并吸引寻找方便支付选项的新客户. 它使您的卡产品现代化,并与当前的市场趋势保持一致.

No Tech Barrier with BNPL SaaS

您可以使用BNPL软件即服务(SaaS)轻松地将BNPL解决方案集成到现有的卡片基础设施中。. 这种即插即用的方法最大限度地减少了技术障碍,并加速了实施.

Bypass Checkout and POS Complexities

BNPL允许您无缝地接触客户,而无需依赖复杂的结帐或销售点(POS)基础设施. 这种简化的流程提高了客户的便利性和满意度.

Responsible BNPL Practices

通过您的卡提供BNPL使可持续的BNPL模式与负责任的贷款实践成为可能. 这在持卡人之间建立了信任,促进了长期的财务健康.

将BNPL选项集成到您的卡产品中符合消费者趋势, promotes financial inclusion, and strengthens your competitive position in the market. 这是一项战略举措,不仅使终端用户受益,增强了支付灵活性,而且还推动了银行的业务增长和客户参与度.

Risks associated with BNPL and How to mitigate them

尽管在信用卡上十大正规博彩网站评级现在买以后付的服务有很多好处, 提供商必须意识到潜在的风险,并实施适当的实践来减轻风险. 例如,去年,美国货币监理署(OCC) 提供了指导 on managing risks associated with BNPL lending for the U.S. It contains a list of risks that includes the following:

- 缺乏明确的, 标准化的披露语言可能会掩盖贷款的真实性质, resulting in consumer harm, or present a risk of violating prohibitions on unfair, 具有欺骗性的, or abusive acts or practices.

- The highly automated nature of BNPL lending, 即时的信贷决策和频繁的对第三方的坚定依赖, can elevate operational risk, including elevated first payment default risk from fraud.

- 贷款人可能缺乏有关申请人BNPL借款活动的全面信息, 因为信用报告机构通常对BNPL贷款数据的获取有限. 这种不完整的报告可能使贷方在批准新的信贷额度之前评估申请人的总债务义务和财务承诺具有挑战性.

To mitigate those risks, OCC suggests the following practices:

Credit Risk Management

Banks are advised that methods to collect BNPL debt, 减轻损失, 联系借款人可能需要与传统的消费者债务催收实践不同的专门方法和策略. With regard to charge-off practices, 银行应适当调整其冲销政策,以配合不良贷款的短期性质.

Operational Risk Management

Banks are advised to establish: internal controls and processes for handling merchandise returns and merchant disputes; processes to confirm that potential borrowers are of legal age to obtain credit; procedures to address first payment default; controls to identify suspected fraud in a timely manner; and risk models.

Third-Party Risk Management

管理与BNPL贷款有关的第三方关系所产生的风险, such as relationships with 商人, 是必须的.

Compliance Risk Management

建议银行管理层考虑消费者保护相关法律法规对银行特定BNPL产品的适用性, particularly with respect to product delivery methods, 市场营销, 广告, and other standardised disclosures. 他们还应该考虑与自动支付相关的账单争议和错误解决权利和实践, multiple payment representations, 还有滞纳金. BNPL贷款应当纳入银行合规管理体系.

As with any other industry, 意识到风险并采取措施减轻风险对企业的运营至关重要. This is especially true in the financial services industry, 客户和服务提供商的安全是第一位的.

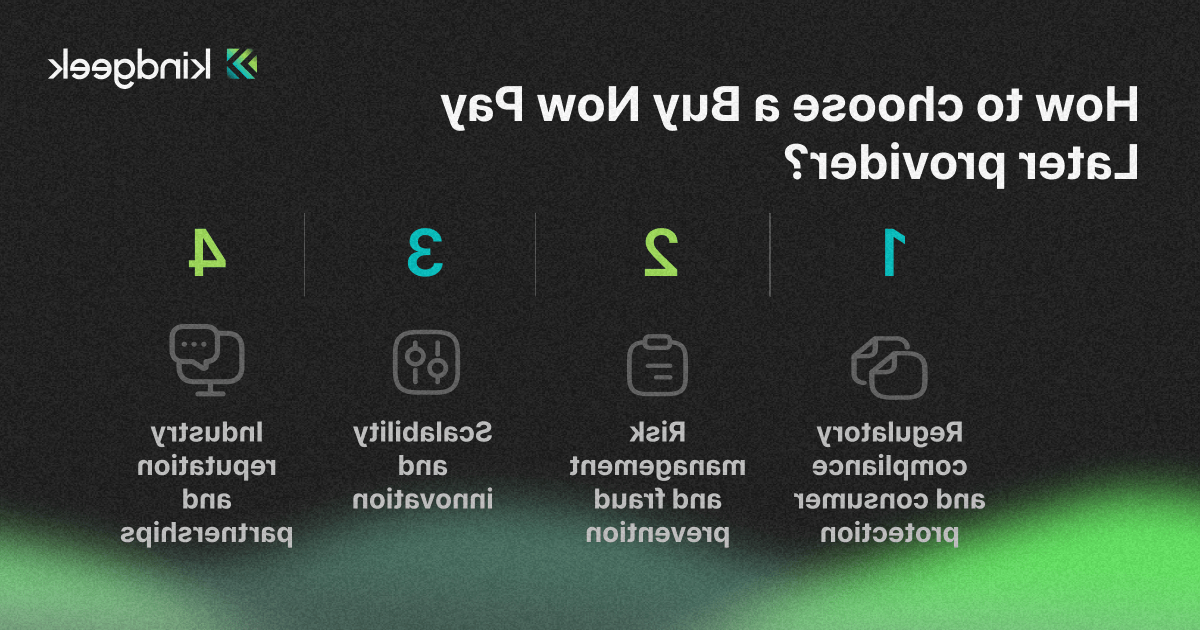

How to choose a Buy Now Pay Later provider?

选择合适的先买后付供应商是一个关键的决定,需要仔细考虑各种因素:

Regulatory compliance and consumer protection

当你为你的业务引入第三方服务提供商时, 确保他们牢记客户的最佳利益应该是优先考虑的. BNPL供应商应遵守相关的消费者保护法律法规. They should prioritise 数据隐私, fair lending practices, and responsible lending principles, fostering trust and safeguarding consumer interests.

Risk management and fraud prevention

BNPL提供商可以访问您客户最敏感的信息, 包括付款方式和其他识别信息,以处理他们的批准检查. 这意味着他们应该有强有力的策略来发现和防止各种形式的欺诈, including identity theft, 账户收购, and synthetic fraud. 他们处理数据泄露和保护客户信息的能力证明了他们对安全的承诺.

Scalability and innovation

As the BNPL market continues to grow, 提供商必须能够扩展和处理不断增加的交易量和客户增长. Their investment in technology, 数据分析, 产品创新对于保持领先于不断变化的市场趋势和消费者偏好至关重要.

Industry reputation and partnerships

研究供应商在行业中的地位以及他们与商家的关系, 银行, consumer advocacy groups, industry associations, 监管机构, and other stakeholders. Providers prioritising transparency, 道德实践, 负责任的贷款更有可能培养信任,保持良好的声誉.

通过彻底评估这些因素并采取整体方法, 在选择与您的业务价值一致的BNPL提供商时,您可以做出明智的决定, prioritises consumer protection, and offers a secure, 透明的, and responsible lending experience.

结论

随着BNPL行业不断发展并获得主流采用, 很明显,这种替代融资模式既带来了机遇,也带来了挑战. 企业必须根据法规遵从性等因素仔细评估BNPL提供商, consumer protection measures, risk management strategies, and overall reputation. 与信誉良好、负责任的BNPL供应商合作是确保良好客户体验的必要条件.

In the ever-evolving landscape of financial services, BNPL代表了我们如何看待和处理消费贷款的重大转变. As with any disruptive innovation, 以深思熟虑和见多识广的心态来对待BNPL是至关重要的, 利用它的好处,同时意识到它的潜在缺陷.